Can contribute 100 of base salary and Dearness Allowance. I worked for an employer from 2012 to Aug 2018 lets say A and then joined company BPF under Trust account from Sep 2018 will be resigning this month and will join Company C in Mar 2019.

Govt Reduces Pf Administrative Charges Effective From Jan 2015 Sap Blogs

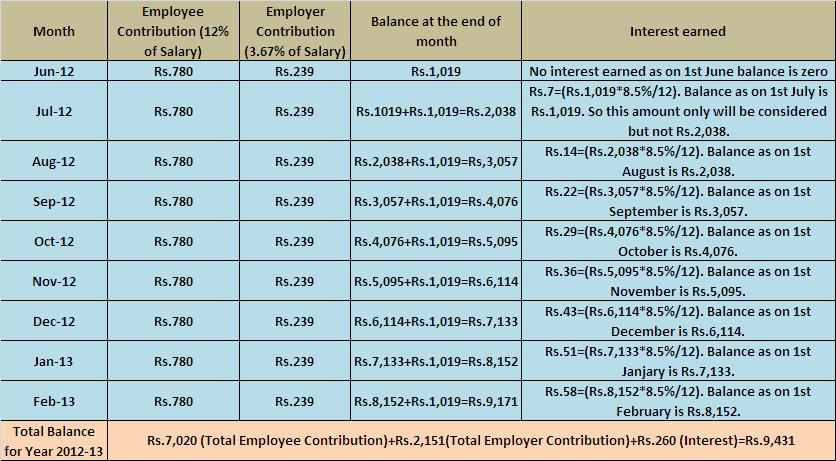

As mentioned earlier interest on EPF is calculated monthly.

. The EPF interest rate for FY 2018-2019 is 865. EPFO provided an 85 interest rate to all its members on their cumulative EPF contributions year 2020-21. For all your contributions the government guarantees a minimum paid dividend rate of 250 for Simpanan Konvensional.

Also as per Budget 2018 the rate of interest applicable on EPF is 865. To better understand how EPF can help you take a look at how you and your employer contribute to it. Total EPF contribution every month 1800.

The EPF interest rate for FY 2018-2019 was 865. EPF contribution is divided into two parts. EPF Interest Rate.

September 2 2020 at 711 pm. However the maximum deduction that can be claimed is Rs 15 lakh including all other investments and expenses allowed under the section. The EPF interest rate for the fiscal year 2022-23 is 810.

BasuNivesh June 6 2022 Category. You are so helpful. In your case it must be 12 of your Basic salary.

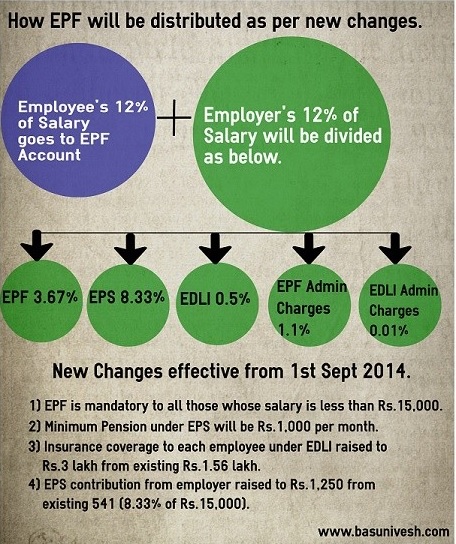

Fund contribution rate from 833 to 10. 15000- even if PF is paid on higher wages. Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550.

EPF Dividend Rate. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. The Employees Provident Fund EPF is a scheme in which retirement benefits are accumulated.

A 3702018-Employees Provident Fund Amendment of Third Schedule Order 2018. Decided by EPFO in consultation with Finance Minister. 12 contribution from employer and employees.

It is your liability to show the income for India. The interest rate on EPF is reviewed on a yearly basis. EDLI contribution is paid even if member has crossed 58 years of age and pension contribution is not payable.

As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. So lets use this for the example. EPF Contribution Rate 2022.

The contribution rate for employees and employers can be referred in the Third Schedule EPF Act 1991 as a guide. Percentage of contribution Employees Provident Fund. Employers must remit the employees contribution share based on this schedule.

Contribution to be paid on up to maximum wage ceiling of Rs. The CBT is led by the Labor Minister. The employee can voluntarily pay higher contribution above the statutory rate of 12 percent of basic pay.

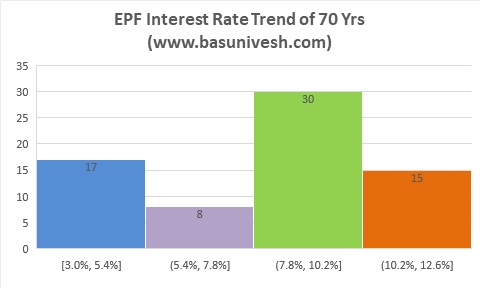

Could be withdrawn if unemployed for more than a month taxable if. After the recent Government approval for an 81 interest rate on EPF for FY 2021-22 many. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

As mentioned earlier. Their rate of interest in 2019-20 remained unchanged at 85 per cent an eight-year low. As of now the EPF interest rate is 850 FY 2019-20.

Employees contribution towards EPF 12 of 15000 1800. Hope the above helps. Online EPF Transfer from Previous EPF account to currentnew PF account - Details Procedure.

If EPF contribution is still going on then it must be based on the rules of salary. When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year. Employees Deposit Link Insurance Scheme EDLIS 05.

Further the income tax return for 2018-19 ordinarily could be revised up to 31 March 2020. This privilege is only for the first three. Due to the recent Covid situation the ITR for 2018-19 can now be revised up to 30 June 2020.

Lock-in period of 5 years. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835. For each employee getting wages above Rs.

2018 at 100 PM. Each contribution is to be rounded to nearest rupee. Male employees must contribute 10 or 12 of their basic salary.

Maximum contribution of up to Rs15 lakh per year. But this rate is revised every year. Thank you so much.

Lets use this latest EPF rate for our example. Division of EPF contribution. Presently the following three schemes are in operation.

Contributions for a particular month will be eligible for dividend based on the. 22091997 onwards 10 Enhanced rate 12 a Establishment paying contribution 833 to 10 b Establishment paying contribution 10 to 12. 15000 amount will be Rs.

With this 172 categories of industriesestablishments out of 177 categories notified were to pay Provident Fund contribution 10 wef. Employee Pension Scheme EPS 833. So the EPF interest rate applicable per month is 86512 07083.

Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. Know EPF or PF interest rate year wise PF interest calculation tax benefits on EPF contribution. EPF Interest Rates 2022 2022.

Current EPF Interest rate is 85 pa. Per Annum Simpanan Shariah. What is the dividend rate for EPF Self Contribution.

The eye opener in the appended link is that a major. Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until year 2022. Under the scheme an employee has to pay a certain contribution towards the scheme and an equal contribution is paid by the employer.

Epf Interest Rates 2022 Epfo Cuts Interest Rates From 8 5 To 8 1

Epf Contribution Rates 1952 2009 Download Table

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

What Is The Epf Contribution Rate Table Wisdom Jobs India

Is Employees Provident Fund Epf Still A Winner In March 2022 Despite The Lowest Interest Rates In Over Four Decades Why Quora

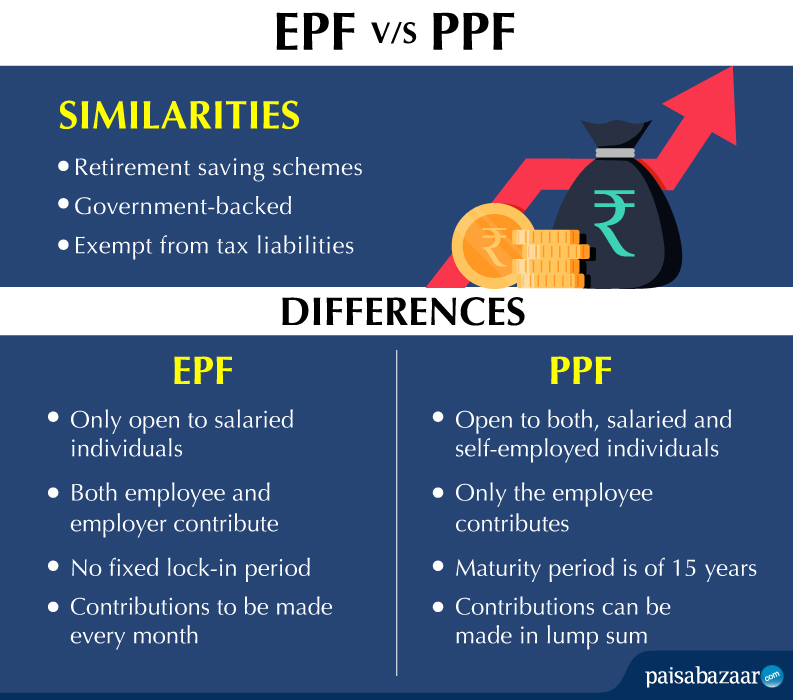

Differences Between Epf And Ppf That You Must Know About

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Epf Contribution Rate For Employee And Employer In 2019 Planmoneytax

Epf Contribution Reduced From 12 To 10 For Three Months

Epf Interest Rate 2019 2020 Historical Interest Rates From 1952 To 2019 Basunivesh

Gold Price Movements In India 1990 2019 Gold Bond Gold Price Investment In India

Latest Pf Interest Rate And The Procedure To Calculate Pf Interest

Growth In Epf Subscriptions And Scale Of Operations Over The Years As Download Scientific Diagram

How Epf Employees Provident Fund Interest Is Calculated

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

The Central Board Of Trustees Of The Employees Provident Fund Organisation Epfo On 21st February 2019 Announced An Inter Informative Online Work How To Know

Epf Vpf Historical Interest Rate Interest Rates Rate Historical

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

Check Epf Claim Status Naroda Pf Office Online Easily Status Kannur Easily